The recently held Leaders’ Climate Summit and the Quad leaders meet has reclaimed the USA’s lost position in the climate change helm and galvanized efforts by the world’s major economies to reduce emissions, to mobilize public and private sector finance to drive the net-zero transition and to help vulnerable countries cope with climate impacts. The Quad coalition also proclaimed a new chapter in the Indo-Pacific competition and promised to collaborate in climate initiatives in the region.

This has proved to be a game-changer in the global climate steps ahead of the United Nations Climate Change Conference, this November and has put India, in specific, on the centre stage of the global climate discourse. The current change in the geo-political scenario can reap golden eggs for the Indian economy, which has manifested itself as the kernel of green project potentials for investors. This is evident from the fact that in the recent visit to India, John Kerry, the US climate czar, emphasised the importance of India as a “red hot investment”.

Although India has not pledged a “net-zero” carbon emission as China has, it has made 3 quantitative commitments under the Paris Agreement. However, to substantiate the green transformation, India will require ~ USD 170bn/year for climate action from 2015-30, of which only an average of $ 19bn was financed between 2017-19, out of which $17bn was lost due to greenwashing of funds in other activities to climate. With the ongoing covid-19 pandemic, the climate goals have been impeded with expenditure cuts and funds channelling towards high-priority sectors like healthcare and public welfare.

To rub along the situation and fill this gap in India, four dynamic shifts are necessary: Scale, balance, risk, and regulation in the green finance space. India needs ground-breaking reforms to leverage international finance in the green sectors, which accounts for only 10% of the total investments in the sector. The world’s largest sovereign wealth funds, pension funds and institutional investors like AXA Group, GPIF, Enel, Macquarie Group must not back off from investing in India, considering it a risky venture. Besides this, it is the best time for the Indian diaspora to emerge as a catalyst and collaborator in mobilising the funds and employing their expertise towards green finance. This will also enable recognized channels of funds and swift allocation of funds.

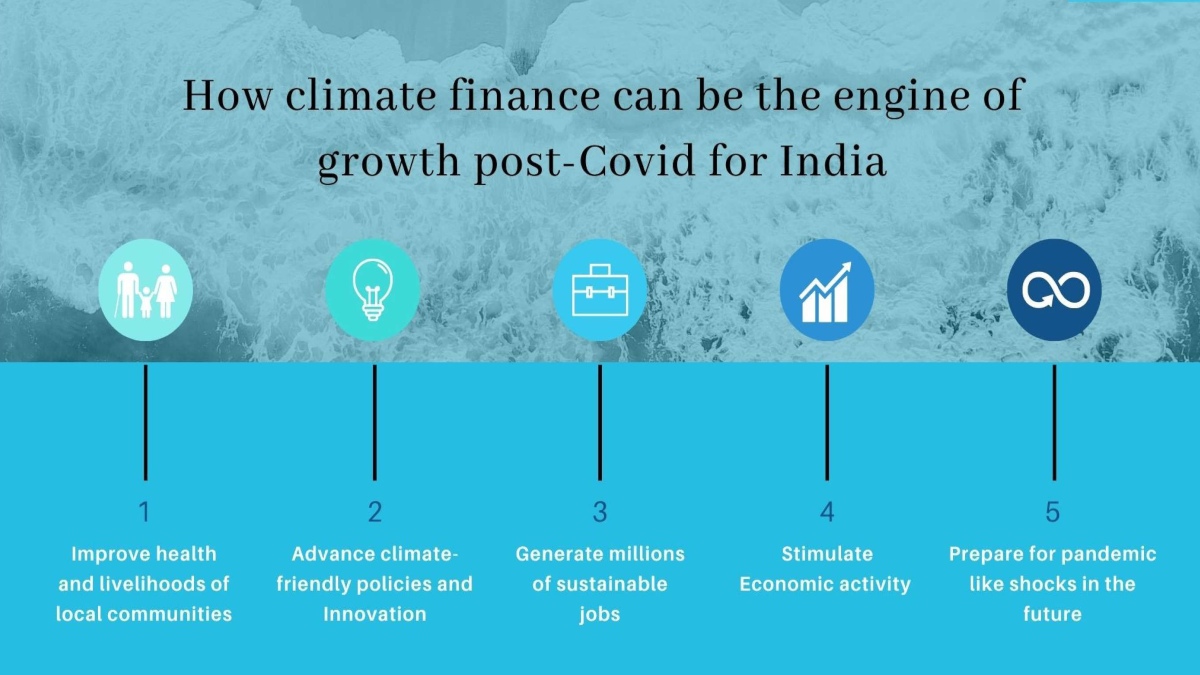

Until recently, environmental protection and economic growth were viewed as irreconcilable goals by developing nations like India, which added burdens on the fiscal health of the country with no real economic value. However, with the advent of technological advances in India and the global Environment, Social & Government (ESG) vogue, green initiates are seen as a virtuous post-covid recovery catalyser by India.

India’s new green job creation can be a game-changer for the economy, especially for the rural community with the majority of the jobs being available for unskilled and semi-skilled workers. People who are considered ineligible for several permanent and well-paid jobs can get maintenance and operations, installation, and sales jobs in this sector. Investments in climate-resilient infrastructure can also support remote populations and smallholder farmers adversely impacted by shocks such as the pandemic through increased market access, improved crop productivity, and greater food security. Investments in low-carbon energy access will also induce sustainable forestry practices which can generate economic returns & employment and improve the health of COVID-19-affected indigenous communities.

On the flip side, there are negative externalities attached to climate change, which extends long-term and only gets worse with time. Increasing storms, heat waves, and floods will impact India harder than almost any other nation, with up to 4.5% of our GDP annually at risk according to a report by McKinsey Global Institute.

Currently, debt accounted for 54% of the total tracked green finance in India. However, such instruments as green bonds can have a detrimental effect on the energy sovereignty of the country since most of the energy projects are long-term capital intensive with slow cash inflows and face price controls over transmission, making them susceptible to failures and crowding out of private funds. Instead, India should welcome international finance in the form of equity and specifically in the development of electricity storage technologies and manufacturing of solar panels and wind energy equipment, 80% of which are imported from China. This will foster the development of green technologies, spur the supply of such equipment in the country and bring down the installation fixed costs. Over the long-term India can then think of steering towards a net-zero at a lower cost, which is currently a major bottleneck.

India has moved a long distance in its approach to climate change – from being seen as obstructionist to seizing the tech and economic opportunities of climate change by metamorphosing its approach to become an epitome of climate combat warrior.

The bottom line is that the COVID-19 crisis has already put us at risk of a two-speed world. Developing countries like India are much worse hit and are likely to take longer to recover. Although lending to developing countries to reduce the effects of climate change, expanded to $78.9bn in 2018, developed nations should provide financial assistance outside their domestic territory to maintain a balance between the two worlds and meet the aim to mobilize $100bn per year by 2025. This can start with the US contributing the $2bn towards the Green Climate Fund, which it promised in 2008 but shunned away incessantly.

Rajesh Mehta is a leading consultant & columnist working on Market Entry, Innovation & Public Policy. Uddeshya Goel is a financial researcher with specific interests in climate change and innovation.

“India’s new green job creation can be a game-changer for the economy, especially for the rural community with the majority of the jobs being available for unskilled and semi-skilled workers. People who are considered ineligible for several permanent and well-paid jobs can get maintenance and operations, installation, and sales jobs in this sector.”